Startup Investment Portfolio Game: Results

Back in 2011 I wrote a post titled “Startup Investment Portfolio Game” where I started a list of “companies I would invest in if I could” to look back on in the future. This post is intended show how the startup investment picks list would have done as a venture capital portfolio as well as provide a few observations and learnings looking back on everything.

The initial list contained 37 startups, and over the last 6 years I’ve been periodically adding companies to the list that I like, bringing the total to 144 startups today. The Wayback Machine has been taking snapshots of this list over time, which should help verify the dates that the companies were picked and that I haven’t changed anything (not perfect, but good enough). The results exclude companies added in the past 2 years as they haven’t had enough time to materially change in value, but I’ll highlight some of my favorites from those at the end.

Methodology

It is not a straight forward process to quantify the performance of a list of privately held companies. Even investors that do this for real have a hard time with valuing a private company portfolio, and they have full disclosure into all the terms and financials of the rounds and companies they invest in. Each approach and methodology has several flaws, and I’ll attempt to outline the tradeoffs with my own for this at the end – there are a LOT here. It’s clearly easier to settle on the “right investment approach” with data in hindsight to maximize returns, so my approach to measuring everything attempts to mitigate that.

I settled on blindly investing 10% of the next round amount of financing for the companies after the pick at any stage, at any valuation, and at any date in the future. We also don’t use techniques like pro-rata to minimize dilution to double down investments that seem to be doing well during later rounds of financing as this would be impossible to do objectively in hindsight. I used data from Pitchbook to look at the next round of financing after I “picked” the company, which usually has a post-money valuation amount (to calculate initial ownership), and also has the diluted ownership of those shares today.

As an example, the initial list picked Square on April 10th, 2011. According to Pitchbook, they previously raised $10.12m total through their Series A that closed 16 months prior. Their Series B was 6 months after the pick, where they raised $31.75m at a $232.92m post-money valuation, giving the Series B investors 13.6% of the company. Our scenario would invest 10% of the Series B amount of $31.75m (or $3.175m) giving us an initial ownership of 1.36% of the company. From additional rounds of financing, the Series B shares were diluted from 13.6% ownership to 10.49%, so we would presently own 1.05% of the company. Square is now publicly traded, so our initial $3.175m Series B investment would currently be worth $74.24m, which is a return of 24.4X.

This very obviously presents several flaws, including the “How is someone with no track record going to participate in these financing rounds?” and I’ll address some of those in the caveats section below. The purpose of this post is purely to quantify how this list would have done if someone was able to make the investments.

Results Summary

Of the 113 companies that were picked from over 2 years ago, 89 have raised an additional round of financing that we could participate in with our hypothetical investment (“what about the other 24?” is discussed at the end). If you invested 10% of the next round for those 89 companies, you would have invested $151.9m and your ownership would be worth $735m today, which is a 4.8X return before management fees. Between the 4 IPOs and other exits, $245m is realized and the other $490m is on-paper value. This would put our hypothetical investment fund among some of the best returning venture funds out there today, especially considering this doesn’t include follow-on investments with companies that are doing well (like Pinterest, Square, and Stripe – though those would be less distinguishable than today from their less-successful peers at the time).

If we avoid investing when the pre-money valuation of the next round is above $250m, we miss out on 5 of the 12 inevitable unicorns, but our capital invested decreases from $151.9m to $82.8m and we have a 7.5X return.

Raw Results

Startup Investment Portfolio Game Results

Startup Investment Portfolio Game Results

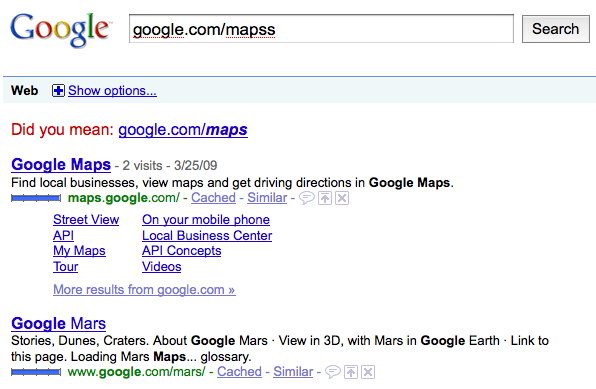

Company Highlights

Of the first 89 hypothetical investments, here are some of the highlights. It’s interesting to note that just about all the good picks are from 2011, and it’s not clear to me if that’s because those companies have had the longest time to become valuable, that year was an especially good time to invest, or if I’m getting worse at this over time. It could very well be all three. A lot of these logos are very recognizable brands today, but that wasn’t necessarily the case when the picks were made.

Industry Comparisons

Correlation Ventures released a study that shows how venture financing outcomes are distributed from 21,640 financings between 2004 and 2013. Based on their data, only 4% of VC financings return more than 10X and only 1.5% return more than 20X. This data covers enough financings that we can loosely assume that it represents the probability of a return multiple for any VC investment.

Modeling our investments as “trials” and successes in a Binomial distribution, we can calculate the likelihood that the investments picked and their return multiples are random. If you randomly chose 89 startup investments from the pool of all startup investments, we would expect to have 7 or more investments with 20X+ returns (like our portfolio) only 0.04% of the time (or once every 2,500 times). This is roughly the same as taking a coin and flipping heads 11 times in a row.

CBInsights ran a report breaking down the involvement of VC firms in billion dollar exits from 2004 to 2013. There were 45 billion dollar company exits that 104 VCs invested in, but 68 of them only participated in a single billion dollar exit. Sequoia, Greylock, and NEA each participated in 8 of the 45 billion dollar exits – incredibly impressive, and that’s with real money and not a fake hypothetical list.

With outcomes this large, there is a BIG difference between investing in the Series A and Series D rounds, and they have vastly different return profiles. Investors in early rounds will see exponentially greater returns than later stage investors tagging along at the end for the logo. The 3 firms above are represented by the dot on the right and collectively represent 24 investment exits. 50% of those investments were in the Series B round or earlier.

Our list includes 5 $1B+ exits and an additional 7 companies that are worth that much on paper. Of those 12 unicorn companies on the list, we would have participated in the Series B round or earlier for 75% of them (vs. 8 and 50% above). The time periods for the two groups aren’t the same so it isn’t fair to directly compare, but this helps put things in perspective. In summary, the picks were fairly bold, early, and accurate.

Caveats & Observations

Getting into high profile deals (like a lot of these were for the logos above) is very difficult as there are usually a lot of iconic venture firms competing for the deal. This analysis in no way attempts to account for the likelihood that we’d even be able to get into the next round of financing. In short, that wouldn’t happen; and in VC, access is king.

It is also disingenuous to completely eliminate the 24 firms that we “picked” but never raised a follow-on round of investment. If our hypothetical venture firm had enough clout to get into the 89 deals this analyzes, some of the other 24 companies would have successfully raised another round that we would have participated in and likely lost money on. This is difficult to model, but I’m open to ideas for how to account for this. However, I don’t believe it changes the returns too significantly as 10 of those companies were acquired and the majority of the other 14 were at the Seed stage.

The original list includes a star mark next to some companies to indicate ones I thought were “extra special” opportunities at the time. Of the 89 investments, 47 have stars next to them. If you only invested in the starred ones, the returns increase from 4.8X to 6.0X. If you apply the $250m max pre-money valuation criteria limit as well, the returns increase from 7.5X to 10.9X. The increase in returns is primarily due to removing companies that aren’t Square, Pinterest, or Stripe and letting those command a greater percentage of the total capital initially invested. 7 of the 12 companies valued at over $1B have a star next to them, so I unfortunately wasn’t any better at pinpointing the unicorns vs. just putting them on the list to begin with.

Of the 12 unicorns in the list, the picks were made an average of 8.75 months before the companies’ next rounds of financing. GitHub hadn’t raised any money prior to our pick, and it was made almost 18 months before their $100m Series A investment from Andreessen Horowitz. Would any of these companies have done their round earlier?

A majority of the companies were discovered by reading blog articles, which are often about a financing round that we would have just missed out on. This isn’t too different from how a traditional firm discovers companies outside of their normal deal flow, but this analysis also assumes that we get into 0% of the companies’ previous rounds. If this was an actual venture firm, we would have a much different type of exposure to companies that are actively fundraising, and this would impact the returns our portfolio would have (though it’s also not clear if this is positive or negative).

Something that’s interesting here is the stark difference in how these companies were picked vs. how a traditional venture firm actually works. I’ve never been “pitched” by any of these companies, done any diligence on any of them, or even met any of the founders in person in the context of an investment opportunity. These companies are picked purely by reading about them, seeing what’s shipped so far, and digesting how the company portrays its vision for how the future will work. The picking process doesn’t consciously account for any of the other social signals that affect fundraising, but maybe that’s not a bad thing.

Of the picks from the last 2 years that aren’t in this analysis, some of my favorites are: PlanGrid, FlexPort, Starship, AirTable, Lilium, and Starsky.

This was a fun exercise, and I intend to keep updating the companies going forward. Maybe one day the list won’t be hypothetical. 🙂

Where’d The Water Go? Google Maps Water Pixel Detection With Canvas

An enhancement to a product we’ve been working on recently included a mockup of a business logo overlaid on a Google Map with people scattered randomly nearby intending to represent potential first time customers.

Facebook, Find My iPhone

Find My iPhone is a nifty feature in Apple’s iOS that shows a map of wherever a person’s phone is. While the main purpose of this feature is listed as finding misplaced phones, most people tend to presciently enable it hoping to recover their not-yet-stolen phone.

David Pogue, a New York Times technology writer, recently had his phone stolen and was using the Find My iPhone feature to locate his phone, which found its way to a rough part of Maryland. Being a high profile person, Pogue was able to get the help of a local police officer who said he would knock on the door where the phone’s GPS was located and ask for the phone. Because the GPS accuracy varies, the police officer said that getting a search warrant would be tricky and that if the person simply denied stealing the phone that there wouldn’t be much more they could do. In a separate case, police in Ottawa denied granting a search warrant based on location alone stating that: “Just because an app says that this is the location of where a laptop is or where a device is, it doesn’t provide us with the full picture”.

With the recent additions of Facebook to iOS6, Apple should also include Facebook in its Find My iPhone application. This would effectively give you the full identity of whoever stole your phone, which coupled with the location data, should be more than enough to justify a search warrant. While not everyone uses Facebook’s mobile application, its use is more common among young people (who are more likely to steal a smartphone to begin with). This would not only allow people to retrieve their stolen phone, but would also deter thieves from taking the phone in the first place because they wouldn’t be able to use Facebook.

Another solution is for Facebook to implement this themselves since a thief might be able to get around Find My iPhone by wiping your phone first. Facebook already shows you devices that your account is connected to and optionally allow you to require Two Factor Authentication when logging in from a new device. They have a unique identifier within the app that knows the Device ID, so it wouldn’t be that much more for them to also show other accounts connected to the same account in the specific case of smartphone apps since it’s highly unlikely for multiple people to use the same smartphone.

GitHub is Eating the World

About 11 months ago, Marc Andreessen, founding partner of venture capital firm Andreessen-Horowitz, wrote an essay titled “Why Software is Eating the World”. In it, he claims that industry leading corporations that fail to adapt by making technology the core of their business will be “creatively destructed” by startup companies.

Plenty of comparison has been made about the opportunity for GitHub to capitalize on the increased amount of software being written with their plans to further support development teams with plans and pricing for individuals, small businesses, and enterprises. GitHub has grown from bootstrapped to being valued at $750m without raising any outside funding, and I think the real value Andreessen-Horowitz sees lies far beyond GitHub’s current business model of monthly service plans.

It’s no secret that there is a significant engineering talent crunch for filling technical roles in companies. I’m asked fairly regularly if I know anyone available looking for programming work and my response is almost always look on GitHub for people who have written code in the languages you’re looking for – you can filter search queries by location and the programmer’s email is almost always included at the top of source-code they write.

If the talent crunch is as pronounced as recruiters and founders say it is, and technology jobs continue to transform previously untouched industries, then GitHub is sitting on an active database of the most in-demand user base in the world. Today GitHub is monetizing its viewership with a public jobs board, but in the future they could match technology job seekers with potential candidates in their user base by the type and quality code they’ve written, and that is a multi-billion dollar opportunity.

If you liked this post, you might also like Startup Investment Portfolio Game.

Startup Investment Portfolio Game

I read about technology news and startups fairly regularly and often find myself saying “man, I wish I could invest in them”. I thought it would be a fairly fun exercise to compile a list of companies I’m excited about now and look back on them in the future. For the past few months I’ve been maintaining a Google Spreadsheet of startups I would invest in if I could. If I had money to invest in private companies, these are the ones I would look to get involved with.

Last Company Added:

Update: Read Results Followup Post, published May 15, 2017

| Company View Notes | Date Picked | Prior Raised |

|---|---|---|

| 20n | 2/26/2015 | $100k (YC) |

| Synthetic Biology will revolutionize the nearly $1T specialty chemical market. This founding team has the right skills and background to lead the pack. | ||

| 3D Robotics | 2/10/2014 | $35m |

| Leader in consumer oriented drone technology, which will be a huge market as drones become more pervasive. | ||

| Andromeda Surgical | 8/7/2023 | $500k (YC) |

| Building AI-enabled surgical robots. Very cool and impactful category, with tie-ins to well known systems like the “da Vinci surgical” robots. | ||

| Anyplace | 4/26/2018 | $2m |

| Inversing the AirBNB and Hotel model. Seems like an easy option for staying in a city for a few months where convenient hotel amenities are offered. | ||

| AnyVivo | 5/8/2012 | $20k |

| Tackling just about the only e-commerce vertical Amazon won’t touch – which also happens to be a $40b industry: pets. Plus, jellyfish (their first niche) are wicked cool. | ||

| Airware | 3/26/2013 | $100k |

| Marketplace and platform for unmanned arial vehicles, or “Drones”. Automated hardware, some of which will be mobile, will shape the future and create many billion dollar industries. | ||

| Airtable | 1/27/2017 | $11m |

| Very cool product that looks like a viable SaaS threat to Google Docs (Sheets) as well as Microsoft Office (Excel). Can see this exiting similarly to Quip, which was purchased for $750m by Salesforce. | ||

| Algolia | 4/3/2017 | $18.3m |

| Stripe is to payments as Algolia is to search. Very well built product that appears to be doing well financially. I’m paying for it for a number of projects. | ||

| Arcol | 11/22/2021 | $0 |

| A Figma-like editor experience for architecture and other building-related documents and planning. | ||

| Ark | 3/25/2012 | $250k |

| Facebook and Google are inherently incentivized not to build this product themselves. A lot like Greplin in that it allows searching private “locked” data, but this is very well fine-tuned for people. | ||

| AuntFlow | 6/8/2017 | $0 |

| DollarShaveClub-type opportunity for feminine products for businesses. Huge opportunity, great mission, and awesome founder. | ||

| Authy | 11/28/2012 | $170k |

| Twilio for 2-Factor Authentication. Team has lots of experience and knows how to scale this. | ||

| Automatic | 3/12/2013 | $100k |

| Vastly improves the most expensive computer you own: your car. Lots of lucrative plays for enterprise/fleet customers with many established potential exits. | ||

| BackType | 4/10/2011 | $1.32m |

| Incredible team of “Big Data” engineers. Solving interesting problem of optimizing marketing around social media data. | ||

| BankSimple | 4/10/2011 | $3.09m |

| Online banking is absolutely awful. Policies and answering basic financial questions are way too complicated for the average consumer. Industry is ripe for disruption. | ||

| BetterStack | 4/15/2022 | $0 |

| Looks like a well-built platform for DevOps with integration into other leading platforms for logs/graphana and uptime measurement. It looks positioned as an ecosystem of tools, which becomes exciting from a SaaS opportunity perspective. | ||

| Bumble | 7/31/2015 | $0 |

| Intriguing approach to mobile dating that appears very well executed technically. Product feels sticky, and addresses a lot of the stigma usually associated with online dating. | ||

| BitCasa | 9/18/2011 | $1.3m |

| Eventually local storage will be indistinguishable from data stored remotely (“in the cloud”). A solution like this will be how this is accomplished. | ||

| BitPay | 1/13/2014 | $2.55m |

| BitPay is well poised to be very large embedded players in the online BitCoin payments market, which doesn’t appear to be going anywhere anytime soon. | ||

| Boundary Layer Technologies | 3/17/2019 | $120k (YC) |

| Higher speed ocean container shipping. Would invest at whatever their next round valuation is. | ||

| Breathable Foods (Aeroshot) | 10/23/2011 | unknown |

| Energy drinks are expected to be a $45b+ market in 2014. The Aeroshot is an innovative pure caffein inhaler. Coffee drinkers rejoice. | ||

| Card.io | 6/23/2011 | $1m |

| “Square without the reader”. | ||

| CardSpring | 4/17/2012 | $10m |

| “Closing the redemption loop” is something a lot of companies with big pockets are trying to do. CardSpring has somehow figured out how to expose a developer friendly service that connects credit card numbers to actual purchase data. | ||

| Chartbeat | 7/29/2011 | $3m |

| Leading the space in real-time analytics. Newsbeat should be a huge hit with publishers. | ||

| Checkbook | 3/01/2016 | ~$2m |

| Paper checks are a pain in the ass. Businesses spend $25b per year on fees for sending/receiving checks alone. | ||

| Clara Labs | 3/22/2017 | $3m |

| Impressive AI-based email assistant that has an equally impressive list of customers with a high LTV. Could potentially branch out into other assistant verticals (meeting and call notes), but current product seems to be doing just fine. | ||

| CloudApp | 5/9/2011 | unknown |

| Love this product. Well built and designed. No clue if the business model works, but it’s almost identical to Dropbox. | ||

| Cloudera | 4/10/2011 | $36m |

| Forefront of “Big Data” trend and generally regarded as the leader in commercially available Apache Hadoop. Disclaimer: I was previously an intern and built their website. | ||

| CloudFlare | 6/21/2011 | $2.05m |

| Will eventually be the security and performance backbone of the internet. Already processing 15% of all internet traffic. | ||

| Coinbase | 2/28/2014 | $31.7m |

| Virtual Currency is here to stay, and Coinbase looks to be the trusted marketplace that will make this (trillion dollar[!!?]) industry happen for the masses. | ||

| Convoy | 10/27/2015 | $2.5m |

| Uber for the $600b freight industry. | ||

| CoTap | 5/29/2013 | $5m |

| “WhatsApp for Business.” Like Yammer, this will be a ~$1b exit. | ||

| Couchbase | 4/10/2011 | $10m |

| Innovative marriage of NoSQL and RDBMS database systems. Memcached is Everywhere. | ||

| Cover | 3/24/2016 | $120k (YC) |

| Lots of bloat in insurance with a huge opportunity to modernize to a mobile-first world. | ||

| Curebit | 8/14/2011 | $170k |

| Injecting themselves into the online commerce feedback loop and creating tools to increase virality sounds like a win to me. Team’s also demonstrated that they’ve done it before. | ||

| Diffbot | 5/31/2012 | $2m |

| Very versatile crawling/parsing api that, as a developer, i know is in high demand. | ||

| DITTO | 2/11/2013 | $3m |

| Incredible technology that remedies the number one problem with buying clothes online: will it fit? | ||

| Doctours | 7/09/2019 | $0 |

| Marketplace for medical treatment. It’s hard to find a more frustrating problem than insurance vs hospitals and healthcare costs. Starting with medical tourism seems like a good place to start if you wanted to eventually break into more traditional procedures and treatments. Lots of upside. | ||

| DoorDash | 2/02/2016 | $55m |

| On-Demand deliveries for local businesses of all types. The initial approach will be food, but expanding to all forms of commerce once their fleet is at scale will have incredible upside. | ||

| Dr. Chrono | 5/4/2011 | $20k (YC) |

| One of many potential home-runs in healthcare. Lots of money at stake with digitizing medical records. | ||

| Drifty.co (Ionic) | 8/12/2015 | $3.7m |

| Leading the way in HTML5 cross-native apps. Potentially huge acquisition target for Microsoft, Adobe, Yahoo, or Facebook who want to improve their mobile footprint. | ||

| DropBox | 4/10/2011 | $7.2m |

| Love this product and so do the majority of its 25m users. | ||

| Dropoff | 11/12/2014 | $1.85m |

| The “last mile problem” is the biggest issue for delivering goods and services. It’s undoubtedly daunting, but the upside is tremendous with the right focus (enterprise, not consumer) and team. | ||

| DuckDuckGo | 4/18/2011 | $0 |

| Creating a search engine is probably the hardest thing to do successfully, but DDG could have a prayer with its privacy-conscious approach. | ||

| Dwolla | 11/15/2011 | $1.31m |

| Online equivalent to cash that maximizes network effects and doesn’t have interchange fees. $$$$$$ | ||

| EarthSense | 4/18/2018 | $0 |

| It’s a Roomba for farms! (Crop yield & soil sensors, etc). Haven’t raised any money yet, how do I be the first to give them money? | ||

| Elroy Air | 12/22/2017 | $4.31m |

| Long transmission drone delivery (150lbs to 300 miles), feasible for remote locations and heavier cargo. | ||

| Entocycle | 2/19/2018 | $120k (YC) |

| Pretty wild vision for the future of protein-based food. Could be absolutely huge. | ||

| EmbedFi | 1/29/2021 | $0 |

| It is painfully obvious that the DTCC is a critical piece of modern equities trading that hasn’t been updated in decades. Nothing about this Embedded company has been announced, nor is anything known (to my knowledge) about who’s involved, but this a problem space worth exploring given the upside. | ||

| Equals.app | 6/02/2022 | $0 |

| Really cool tool for data analysts that adds data import sources (Postgres+etc) and Figma-style multiplayer editing to Excel. | ||

| Carta (eShares) | 1/28/2014 | $1.8m |

| Stock Option granting is stuck in the paper world. There is a lot of value in a simple management platform that digitizes private company stock options. | ||

| Estimote | 8/22/2013 | ~$1m (YC) |

| The vision for “An OS for the Physical World” is so ambitious it’s scary. As data collection grows exponentially, Estimote-like sensors will increasingly provide more data to shape retail and consumer experiences. | ||

| Expect Labs (MindMeld) | 9/11/2012 | $0 |

| This could change the way people have conversations digitally. Impressive technology of predictive named entity recognition that could be applied to a variety of other platforms. | ||

| Fab.com | 2/1/2011 | $625k |

| Incredibly brandable domain name. Love the concept and execution so far. | ||

| Fav.tv | 7/22/2011 | $0 |

| World-class design. People are addicted to tv. | ||

| FGSpire (Vetspire) | 9/4/2017 | $0 |

| First product is an AI-based medical record tool for veterinarians, which seems fairly narrow, but could be huge if they applied that platform to other medical fields. Seem to be thinking about it correctly though since vets/animals don’t have the same regulations as doctors/people. | ||

| Findery (formerly PinWheel) | 2/16/2012 | $2m |

| Annotate the world. A service like this couldn’t have existed before smartphone proliferation, and it seems to be the perfect mix between FourSquare and Pinterest. | ||

| FieldWire | 10/27/2015 | $7.7m |

| Digitizing the $7 Trillion global construction industry. Lots of inefficiencies to cut down during the whole process. (See also: PlanGrid). | ||

| FlexPort | 11/02/2015 | $26.6m |

| A marketplace for on-demand international shipping could massively impact global trade. Product is well-positioned to win the space where network effects will be hard to overturn. | ||

| Fly.io | 7/10/2018 | $0 |

| Smart blend between Cloudflare and AWS Lambda in a way that allows you to develop semi-serverless applications that run “at the edge.” Could be a paradigm-shifting way of building apps and services. | ||

| Fraight.AI | 1/11/2018 | $850k |

| Freight brokerage generates ~$60B in commissions per year but is massively inefficient with people conducting most business over the phone or via email. AI bots have been overhyped to date, but this is the perfect application for them in a huge industry. | ||

| Frank | 11/21/2019 | $0 |

| Building tools to help employees more effectively unionize, which could be incredibly powerful if it starts getting adoption. Tons of upside, and fantastic initial team. | ||

| Friendly Robots | 9/21/2019 | $75k |

| Roomba but for industrial sized areas. Clear market opportunity and potential to move into adjacent industries. | ||

| Foursquare | 6/21/2011 | $21m |

| Could be the company that fully unlocks the power of mobile + local offline commerce. | ||

| Fundable | 7/31/2012 | ~$500k |

| A local Columbus company that could make waves in how technology companies get financed via equity – well timed current legislation being passed. Team is extremely talented. | ||

| GenomeCompiler | 8/7/2012 | ~$1m |

| A compiler for creating living things. We have programming languages to abstract computer language, this is a compiler for the language of living organisms, the genome. Video. | ||

| GitHub | 4/10/2011 | $0 |

| Database of the worlds most prominent open-source programmers and the projects they’re creating. “Engineering talent crunch” | ||

| Greplin | 4/10/2011 | $4.72m |

| Solving the “Other half of search”. Don’t know if people have the problem of knowing where some piece of information is in their private web frequently enough for Greplin to matter, but the product/team are ripe for acq-hire. | ||

| Grouper | 9/20/2012 | $170k |

| Super unique approach to group dating that takes the hush-hush stigma out of finding someone online. Growing nationally quickly. | ||

| GraphCDN | 6/17/2021 | $0 |

| Interesting platform that handles the trickier scaling issues of GraphQL around edge caching and invalidation. Could see the expanding into full DB hosting eventually as well. | ||

| Gumroad | 9/5/2012 | $8.1m |

| A bit late on this given it’s likely previous investment valuation, but I still think there’s enough upside for this, and traffic is really starting to take off. | ||

| GeckoRobotics | 3/24/2016 | $120k |

| Initial market of robotics inspection is huge with a lot of potential cost savings and tangential markets to attack. | ||

| Hall | 2/7/2013 | $570k |

| Extremely well built Enterprise productivity suite. The main advantage is the desktop/mobile apps which appear to be built to remain lean and fast. This will be a very large Yammer-esque exit. | ||

| Heal | 8/18/2015 | $5m |

| Uber for on-demand doctors. Could be massive, or crash and burn. | ||

| Hinge | 2/28/2014 | $5.25m |

| I think this app finally nailed the mobile app dating equation. I expect this to explode in popularity once they fix the messaging kinks and are available everywhere. | ||

| HiOperator | 8/23/2016 | $120k (YC) |

| Customer Service is critical for companies of all sizes, and is rarely done well. This company could have massive margins by reducing the inefficiencies of multiple companies into one. Love the potential of this at scale. | ||

| Hipmunk | 4/10/2011 | $5.22m |

| They started with flight search, which is pretty well done and has fans, but if they can solve the awful experience of finding a hotel they will print money. | ||

| Humanoid | 11/02/2011 | $600k |

| Bringing an API to outsourced brainpower. | ||

| IFTTT | 8/09/2011 | $0 |

| Super impressive backend, can tell the product will get easier to use (maybe featured tasks in a gallery?) over time. Lots of creative and helpful uses. | ||

| Impossible Metals | 9/24/2023 | $500k (YC) |

| Creating undersea robots to mine rare metals for battery technology, among other potential uses. Combines a few things I love: the ocean & robotics, capitalistic approaches to solving climate changes, and ambitious projects that can have an outsized impact. | ||

| InDinero | 4/10/2011 | $1.22m |

| “Mint.com for small business”. Collecting an incredibly valuable dataset and will be able to do for businesses what Mint did for consumers. Also, Jessica Mah rocks. | ||

| JustKitchen | 1/21/2021 | $0 |

| Ghost kitchens focused on bringing name brands international. Extremely smart approach that might not ever need to expand beyond its initial set of countries to be huge. | ||

| Kiip.me | 4/10/2011 | $4.3m |

| Banner ads in games suck. The concept of turning achievements into rewards is really compelling, and their team is stacked to do it. | ||

| Kontagent | 4/10/2011 | $5.5m |

| From what I’ve seen, the leading analytics provider on the Facebook platform. Huge acquisition play. | ||

| Landing.AI | 12/14/2017 | $0 |

| Applying AI to manufacturing and warehousing is going to be absolutely massive. Don’t see an industrial application this couldn’t impact. | ||

| Lawdingo | 3/26/2013 | $100k |

| Marketplace bringing efficiency to finding qualified legal services | ||

| Leap Motion | 7/11/2012 | $14.1m |

| This is an incredibly transformative improvement to human-computer interaction with insane opportunity to revolutionize gaming and healthcare (among other industries). Can’t believe the $70 price-point as well. | ||

| LifeSupport | 12/13/2012 | ~$200k |

| Impressive team of networkers, designers, and hustlers. Currently focused on Columbus, but poised for national growth. Everyone hates hangovers. | ||

| Liftopia | 10/19/2011 | $3m |

| Huge market. I love skiing. Win for resorts: reduces risk of volatile weather conditions. Win for users: cheaper lift tickets. | ||

| Lilium | 4/28/2017 | $11.4m |

| I mean, this is just sick. Don’t really see a way this doesn’t get bought for a bunch or become huge on its own if they fulfill their mission. | ||

| Linear | 7/14/2019 | $0 |

| This is what you’d get if you combined the UX and growth concepts of Slack and Superhuman and applied it to tasks and teams. Going to be a massive company. | ||

| Living Carbon | 1/21/2021 | $0 |

| Attempting to genetically engineer trees to capture and store more carbon. Could have a massive impact on the climate if it works. | ||

| Lobe.ai | 5/3/2018 | $0 |

| Insanely impressive demos, and first company I’ve seen to productize the complexities of Tensorflow (and related libraries). Huge potential to create the next wave of AI-backed products in a way that chatbot/text-only systems never could. | ||

| Locker Room | 2/16/2021 | $9.3m |

| Audio conversations in a similar format to Clubhouse, but centered around live sports. Tons of opportunity in this vertical with live scores, play-by-play, and potentially betting. | ||

| LogicGate | 10/05/2016 | $0 |

| Enterprises will increasingly rely on technology to organize their internal compliance and security processes. This company (TechStars Chicago) looks like they have the right team background to tackle these long but lucrative sales cycles. | ||

| MakerBot | 1/13/2012 | $10m |

| My singularity dreading inner luddite loves to fear a company like this. (Read the Wikipedia article on Grey goo). | ||

| Mammoth Biosciences | 4/29/2018 | $0 |

| CRISPR will change many aspects of society over the next few decades, and there will likely be several billion dollar companies formed to help get us there. | ||

| MapWize | 2/6/2019 | $1.36m |

| Indoor mapping will continue to grow in importance as more facilities and areas need mapping for connected and autonomous devices and services. | ||

| Mattermark | 7/26/2013 | $1.5m |

| No brainer buy for every VC out there who, by nature, are very accessible. Can eventually scale to Angels with more geographic focus/restriction to truly become an operating system for private investors. | ||

| Matternet | 3/22/2013 | $2m |

| Delivery will be the “sexiest” application for drones, but their impacts will be far more pronounced in other industries, like agriculture and aid second/third world countries. | ||

| MediaLets | 4/10/2011 | $10m |

| I hate advertising, but MediaLets’ approach with rich-media advertising is the lesser of many evils. Team knows what they’re doing. | ||

| Medium | 8/10/2015 | $25m |

| Extremely high growth with Twitter-like scale. Ease of discovering high quality content is remarkable, and the effects of the content virality compounds with increased network size. | ||

| Meldium | 2/25/2013 | $100k |

| Solving a real problem of Enterprise password management that companies will pay for to simplify. Solid technical team from Amazon and Microsoft. | ||

| MemCachier | 9/5/2012 | $0 |

| Technically sound pre-funding team. Huge space to disrupt, and open-source memcached is the gorilla in the room. | ||

| Milk | 10/19/2011 | $1.5m |

| Kevin Rose has seen the whole spectrum of the dos and don’ts with running a startup between Digg and companies he’s angel invested in. I expect him to take this corpus of experience and build something meaningful; Oink looks like a great start. | ||

| Mighty | 1/12/2021 | $150k (YC) |

| Interesting approach to creating a more performant web browser with rendering happening on the server, instead of shipping down MBs of assets for local browsers to render themselves. | ||

| MindMesh | 4/19/2022 | $150k (YC) |

| There have been a lot of buzzy task and note management, calendar plugins, web snippet reminders, and mind/knowledge mappers pop up over the last few years, but this feels like the right balance of helpful and simple. I love how the early product has progressed and could imagine it being a strong SaaS play down the road for teams or freemium consumer. | ||

| MinoMonsters | 12/04/2011 | $1.17m |

| This game isn’t out yet, but I’ve used a beta version from their iOS developer and it’s like crack. The game mechanics used here are insane. This could be on the same level of Angry Birds in terms of popularity. | ||

| MicroBlink | 10/22/2014 | $0 |

| Computer Vision technologies are hard to develop (valuable IP) and will open up a floodgate of potential new mobile, financial, surveillance, security, and logistics applications. | ||

| MixMax | 3/17/2017 | $1.5m |

| Amazing email productivity app that I use almost daily. Seems like a potentially huge Google acquisition to further separate them from other email providers. | ||

| MixRank | 8/23/2011 | $170k |

| Optimized PPC campaigns on Adsense. No brainer team/product acquisition for Google. | ||

| MobileWorks | 8/13/2011 | $170k |

| Mechanical Turk is great, but result quality is questionably reliable. This approach is extremely well thought out and solves a very interesting and potentially lucrative problem. | ||

| ModernFertility | 8/11/2017 | $1m |

| Lots of parallels to 23andMe for an inexpensive, at-home fertility test that’s 10% of the cost of the clinical alternative. | ||

| MongoHQ | 8/23/2011 | $417k |

| MongoDB is one of the leaders in the NoSQL space and MongoHQ has built a platform growing very rapidly in revenue and distribution. | ||

| MonkeyLearn | 5/30/2018 | $1.2m |

| Creating a friendly UI for building NLP analysis and text extraction. Can see this being part of something much larger, or bridging the gap between the myriad of systems with unstructured data. | ||

| MooCall | 3/17/2017 | $1.31m |

| Tracking cows with an IoT wearable sensor. Can see the early approach with cows being successful, but broadening to any farm animal (or endangered wildlife animals) could be massive. | ||

| Moov | 2/28/2014 | $0 |

| Ex-Apple employees have figured out how to intelligently expose accelerometer data into a Siri-like personal assistant. A lot more powerful than existing products. | ||

| Muzy | 11/04/2012 | $0 |

| Haven’t seen anything reported of funding, but this app has nailed the Open Graph and is exploding. Another different-kind-of-sharing pinterest-like app, but can’t argue with growth. | ||

| Nest Labs | 10/25/2011 | unknown |

| Home automation will play a significant part in energy use reduction and economic efficiency. Nest, tackling the often-looked-over thermostat, is in a great position to do well. | ||

| North (formerly Thalmic Labs) | 2/25/2013 | $1.1m |

| Impressive gesture control for the wearable computing devices that are about to explode in popularity. Very cool use cases with gaming and sports – definitely getting acquired. | ||

| Ocho Wealth | 2/21/2023 | $2.5m |

| Personal 401Ks are fraught with unnecessary (and predatory) fees, when Vanguard/VOO ETFs would be better for 95%+ of consumers. Lots of adjacent financial products they can offer down the road as well. | ||

| Offermatic | 9/29/2011 | $4.5m |

| Closing the redemption loop in offline (in addition to online) commerce. Yodlee is destroying their margins, but this is a huge opportunity. | ||

| OneSignal | 4/19/2017 | $2.47m |

| Getting a ton of usage with their push notification backend which is generating a massive amount of data. | ||

| Ohlala | 8/10/2015 | ~$100k |

| Morality aside, this is a goldmine. Not much else here to say. | ||

| One | 8/03/2011 | $1m |

| Solving a super fascinating problem of location-relevant interest matching. Could be transformative. | ||

| Optimizely | 4/10/2011 | $1.2m |

| A/B testing might be a buzzword, but it’s still incredibly powerful. From using their product, they make running campaigns dead simple. Acquisition target. | ||

| Ot.to | 5/17/2016 | $0 |

| Long-haul Trucking will be radically transformed over the next decade and automation will play a huge role in this. Killer founding team attacking a monstrous market. Could easily be a $10B+ company. | ||

| Outbox | 2/26/2013 | $2.2m |

| Bringing change to a bloated $900b industry (postal mail) – sounds like a huge win. | ||

| Outlier.org | 8/13/2019 | $0 |

| Rethinking the way college education works, where costs aren’t centered around campuses and the baggage of funding or public/private interest groups. Likely one of the biggest problems and opportunities in the country right now. | ||

| PageLever | 8/03/2011 | $20k |

| Significantly improves upon a very minimal Facebook Page Insights product. Well built with and has a clear business model where customers have deep pockets. | ||

| Paladin | 10/13/2017 | $100k |

| Streamlines the connection of pro-bono legal work. Good traction so far, and doesn’t appear to be any credible competition. | ||

| Parade.ai | 8/8/2018 | $0 |

| Applying machine learning to transportation opperations. 3PLs are throwing cash at these problems to combat digital freight marketplaces and stay ahead, and simple tech solutions that actually work could be a game changer. | ||

| Parabola.io | 1/6/2020 | $2.2m |

| The rebirth of Yahoo Pipes, with more applications to be integrated into Robotic Process Automation (RPA) enterprise flows. High growth market and opportunity with lots of upside. | ||

| Path | 11/30/2011 | $11.2m |

| Version 2 of Path makes Google’s previous $100m+ acquisition offer denial look prescient. This is where mobile social networks are headed. | ||

| PearPop | 03/02/2021 | $0 |

| Interesting crossover of a Cameo-like platform for paid influencer promotion. Could easily see brands also using this for more native advertising on social platforms like TikTok. | ||

| Piada | 11/19/2011 | unknown |

| Irrespective of the fact that this is a restaurant that’s only current located in Columbus, Ohio, this is destined to be the next Chipotle. | ||

| PillPack | 4/12/2015 | $12.8m |

| Simplifying drug delivery prescriptions for potentially tens of millions of customers (in the United States alone) is a huge opportunity. Quite a Zenefits-type model, which is also disrupting a Goliath industry with a nascent tech approach. | ||

| PlanGrid | 10/27/2015 | $19.1m |

| Digitizing the $7 Trillion global construction industry. Immense upside, and a well built product with talented team. | ||

| Pocket Gems | 6/28/2011 | $5m |

| Extremely successful independent mobile social gaming company. Backed by Sequoia. No-brainer acquisition for EA or Zynga. | ||

| 7/01/2011 | $700k | |

| Traffic has exploded in 2011. Growing a huge community of people and a database of things they think are cool. Feels like early days of Tumblr. | ||

| Piramidal.ai | 3/1/2024 | $500k (YC) |

| Building a foundational LLM model to diagnose neurological conditions. Think this could unlock significant advancements in our minimal understanding of how human brain and neurons actually work. | ||

| Prometheus Fuels | 10/7/2020 | $150k (YC) |

| One of the most ambitious startups I can think of – attempting to turn Co2 into fossil fuels to go fully carbon neutral. This is a $10B+ company if it works and they stay private. | ||

| PullRequest | 8/9/2017 | $120k (YC) |

| Pull Request as a service. This should be built into GitHub. | ||

| Pusher | 6/9/2011 | $1m |

| “Realtime application as a service”. Love the concept, execution is solid, and the team is riding the giant transition to a more interactive and immediate web experience. | ||

| Quantiacs | 3/15/2016 | $1m |

| Creating a marketplace for financial trade algorithms. Seems the possibilities for “Big Data” to affect the financial markets are endless – everything can be modeled. | ||

| Quora | 5/17/2011 | $11m |

| Definitely a bit too much buzz given their founding team, but if they can effectively get away from the current tech/startup focus into more “normal” topics, they’ll have a goldmine of data/users. | ||

| Rainmaker Technologies | 3/14/2024 | $1m (est) |

| Controlling precipitation intentionally by deploying a mineral in clouds with drones. Could have a massive impact on domestic farming/agriculture output, ski resort season lengths, and avoiding catastrophic damage to cities. | ||

| Rarible | 3/11/2021 | $1.8m |

| Interesting trend with NFTs happening right now, though I’m definitely not the only person who thinks that with crypto and all of the recent success of Coinbase (wouldn’t be surprised to see a huge next round for them). Unsure how the market will evolve, but it’s a good one to have a horse in the race. | ||

| Recurly | 4/10/2011 | $1.6m |

| Implementing payment solutions sucks. Recurly makes subscription billing simple and beautiful. | ||

| Remix.run | 5/23/2022 | $0 |

| Very similar to Next.JS/Vercel in terms of a forward-thinking web app framework, but both seem poised to be the predominant way(s) of building products. Interesting business model with COSS (commercial open-source software), with an obvious Cloud model available at some point in the future. | ||

| Remora Carbon | 3/05/2021 | $150k (YC) |

| Semis are 5% of all vehicles on roads but currently account for roughly 50% of all transportation emissions. Could see federal regulation here similar to the ELD Mandate around reducing emissions. The ELD Mandate exploded KeepTruckin’s carrier adoption and value. | ||

| Replicache.dev | 6/15/2021 | $0 |

| Very intriguing SaaS that enables realtime collaboration, but solves the tricky offline + race conditions + conflict resolution problems (popularized by platforms like Figma). | ||

| RethinkDB | 4/10/2011 | $1.22m |

| Eventually hard-drives will be solid state, and RethinkDB is poised to lead the field. Until that happens, they’re refocusing on optimizing existing HD solutions. | ||

| Retool | 1/8/2019 | $3m |

| Easily build internal tools and reporting software without paying consulting firms 6-figures (or more). Seems like AirTable on steroids. | ||

| RightScale | 5/4/2011 | $42.5m |

| I have no idea why this isn’t built right into Amazon’s Cloud services because managing EC2 clusters manually is awful. | ||

| RobinPowered | 7/21/2016 | $8m |

| Office inefficiencies are stuck in the 20th Century, and there’s a big opportunity to develop an enterprise-first product that uses technology to solve common problems. Feature set is outstanding for only having raised a Series A. | ||

| Root Insurance | 5/11/2017 | $7m |

| It’s completely insane that insurance (not just for cars) is for the most part determined by demographic data only today. This uses a smartphone app to actually quantify how good of a driver you are before providing you a rate. | ||

| Safe | 12/22/2017 | $1.2m |

| App for sexual welness and more transparency in STD testing. Can eventually be used as a wedge into other aspects of Healthcare 2.0 to a highly tech/conscious userbase. | ||

| Seed.run | 1/19/2021 | $150k (YC) |

| Generalizing Serverless deployments for full system architectures (instead of just web apps). Will be huge. | ||

| Scaled Robotics | 8/2/2019 | $0 |

| Autonomous robots for inspecting construction sites. I love everything about this, and would strongly want to invest. | ||

| Sea Machines | 7/25/2017 | $1.5m |

| Autonomous Boats for.. (?) | ||

| SecondMeasure | 8/18/2015 | $120k (YC) |

| The power of being able to trade on information as it happens is wildly powerful. | ||

| SnapGuide | 3/29/2012 | $2m |

| Mobile how-to guides wherever you need them. Extremely well thought out product and will be a mainstay on a lot of users’ phones. | ||

| Shiru | 8/16/2019 | $120k (YC) |

| Big believer in the long-term trend of alternatives to protein, and this looks like an interesting way to programmatically generate them. | ||

| Shone | 6/26/2018 | $4m |

| Retrofitting container ships with autonomous controls. Similar approach to Embark with Semi Trucks. Global supply chain will be radically upended on several dimensions over the next decade(s), and this type of approach could be a huge part of that. | ||

| Shopify | 4/18/2011 | $7m |

| Growing like a weed. No-brainer acquisition by eBay or Amazon. | ||

| Shopkick | 6/22/2011 | $20m |

| Incredible early adoption from merchants like Best Buy. Love the product and approach. | ||

| ShopWith | 8/22/2018 | $120k (YC) |

| Has elements of live video that are sticky like HQ Trivia, and captures all of the brand/promotional behavior that happens on Instagram but isn’t native to the platform yet. Seems like it could be huge since purchasing is built right in. | ||

| Shortmail (410 Labs) | 7/02/2011 | $0 |

| Everyone uses email, but a few rotten users ruin the experience for everyone. Tying accounts to a social authentication system and placing Twitter-like length restrictions may be the cure. | ||

| SigFig | 7/2/2012 | $2m |

| Mint.com for Investments. Clear acquisition for Intuit or wealth management companies which literally and figuratively print money. | ||

| SimpleGEO | 4/10/2011 | $9.81m |

| Being the location backbone of the web has a lot of potential. Killer team. | ||

| SimpleLegal | 8/6/2013 | $170k (YC) |

| Big Data meets convoluted legal fees. | ||

| SnipSnap | 5/29/2012 | $555k |

| Paper Coupons will get replaced by *something* in the digital era. This looks like an interesting proprietary technology that will work with existing coupons on a phone. | ||

| Solve Media | 4/29/2011 | $4m |

| Captchas are annoying and command our scarce attention for an otherwise valuable period of time. This approach is equally annoying for consumers, but at least it makes publishers and advertisers money. | ||

| Sonuum | 7/31/2020 | $0 |

| Multi-player audio editing, looks incredibly well designed and built. | ||

| Sound.xyz | 12/7/2021 | $0 |

| Has the potential to be an NFT/blockchain based Spotify, which I definitely see happening with a huge upside. | ||

| Sourcetable | 10/13/2020 | $0 |

| Very cool concept of providing spreadsheet-like access and functionality to different datasources. Looks potentially like it could be a lot more powerful than Airtable or Retool. | ||

| Spline | 11/26/2020 | $0 |

| Figma is to Photoshop as this is to After Effects. I don’t care where they’re located (Chile) or what their team is so far. They’ve clearly been able to build great software. | ||

| Square | 4/10/2011 | $37.5m |

| Couldn’t be a more lucrative market to disrupt, and Square has all the right pieces in place. | ||

| Starship Technologies | 7/6/2016 | $2m |

| Unsure where the line will be drawn for postmates/bike courier vs. autonomous robots (or what the actual cost breakdown will be), but this seems like the best approach for the later. If it works, potentially a huge number of applications to local/last-mile delivery. | ||

| Starsky Robotics | 5/8/2017 | $3.75m |

| Self-driving truck technology. Pretty clear opportunity here. | ||

| StatMuse | 2/2/2015 | $0 |

| AI for Stats and Analytics. Incredible tech chops. | ||

| Stitch | 3/24/2016 | $120k |

| Could potentially be the OS/platform for modern healthcare treatment facilities. | ||

| Supabase | 8/6/2020 | $120k (YC) |

| Very interesting database technology that looks to take a lot of the best aspects of GraphQL and Firebase. | ||

| Storenvy | 6/21/2011 | $1.53m |

| Similar approach to Payvment, but a more Amazon-like approach with a central website (which is more in tune with how consumers currently shop). | ||

| Stripe | 4/10/2011 | $2m |

| I don’t think any merchants or developers wake up saying “man, I can’t wait to use work with Paypal today”. Stripe has a solid team and solid mission of remedying an otherwise excruciating experience. | ||

| Sunglass.io | 5/23/2011 | $0 |

| Software eats architecture. | ||

| Svbtle | 7/24/2012 | $0 |

| This might appear to be just another blogging service, but something tells me Dustin Curtis has his finger right on the head of the future of quality news production and consumption, albeit it’s limited to technology-oriented writers now. | ||

| Swiftype | 5/8/2012 | $170k |

| Site search is something that is an absolute pain to implement and is something almost every company wants to outsource. Google site search is a very mediocre solution and leaves most developers wanting more – this just may be it. | ||

| Tagstand | 8/19/2011 | $170k |

| NFC will change the way technology interacts the real world. It’s a far ways out, but the companies who will be relevant tomorrow will have started today. | ||

| TemplarBit | 8/23/2017 | $120k (YC) |

| Smart way to avoid XSS vulnerabilities. Unsure if this could be huge, but seems to solve a big problem for larger enterprise customers. | ||

| Tendies.af | 1/29/2021 | $0 |

| Big fan of the idea around “the unbundling of Reddit”, which for r/wallstreetbets has a huge opportunity around building a vertical and specialized community of obsessed investors (via memes, shitposting, etc) who view gains and losses as entertainment. | ||

| Tinder | 1/24/2013 | $0 |

| This is gaining huge traction on campuses and will definitely get more public attention later this year. | ||

| TradeSchool | 1/15/2020 | $0 |

| Re-imagining what education looks like for the working class. Tons of early sharp insights around initial customer acquisition and how the opportunity with employer/training/student matching for trade jobs changes at scale. | ||

| Transcriptic | 12/8/2014 | $4.075m |

| AWS-like platform for Life Science bio experimentation. | ||

| Traverse Technologies |

2/26/2019 | $120k (YC) |

| Simulation software that has the ability to reinvent how alternative energy sites are planed and deployed. Hard to think of a more impactful company to be involved with. | ||

| TruckerPath | 3/07/2016 | $23m |

| Addressing a massively underserved trucker market, which is the most popular profession in ~30 U.S. States. Huge opportunity here with rise in online shopping/”on-demand economy”, the value of goods being transported around the country, the inefficiencies in the current worldwide logistics market, and the impending introduction of self-driving trucks. | ||

| TwoTap | 3/26/2014 | $90k (YC) |

| Bringing a full commerce checkout ad experience into native applications as a platform. Seems smart and like a solid acquisition play for dozens of companies/platforms/brands. | ||

| Turntable.fm (Stickybits) | 6/21/2011 | $1.9m |

| I don’t know if the transition from Stickybits to Turntable could be classified as a pivot.. more like a complete redux. Regardless, I’m addicted to Turntable. That being said, online music startups are notoriously hard to succeed with. I just want a custom avatar. | ||

| Twilio | 4/10/2011 | $16m |

| Have seen their traffic skyrocket after reducing SMS costs. They simplify an extremely painful process of manually building out an SMS solution as all previous ways require convoluted APIs or custom software. | ||

| URX | 10/8/2013 | ~$2m |

| Smart product that natively deep links high-value product purchases in the right place. It’s a new category of mobile ad, but if it works it could be hugely valuable. | ||

| Vercel (formerly Zeit) | 2/11/2019 | $0 |

| Building an incredible ecosystem around React and Serverless tools with Now, Next.JS, etc. They seem to be ahead of a few transformative trends. | ||

| Vetcove | 9/21/2020 | $3m |

| Aggregating pricing of vet pharmaceuticals. Huge opportunity to dominate that category and augment (or get rid of) pharma sales folks with automated and instant price comparison. | ||

| Vimcal | 7/7/2021 | $150k (YC) |

| Pre-seed stage “Superhuman for calendars”.. close your eyes and write the check. | ||

| Vollebak | 11/23/2021 | $0 |

| Extremely interesting clothing company using technology like Graphene and fibers like Dyneema in high performance outerwear and apparel – the former is extremely interesting as it’s never been applied to clothing before (most commonly batteries and silicon chips), and it’s the most conductive material known to man. Could see this becoming an AllBirds or Away-like DTC success. | ||

| Walker & Co | 12/18/2013 | $2.4m |

| Addresses a quickly growing segment in one of the largest markets on earth, Health and Beauty. Traditional CPG companies are behind the eight ball on this one, and a strong branding play will make all the difference in an upstart taking mass market share. | ||

| Warby Parker | 12/19/2011 | $13.5m |

| “Zappos for prescription eyewear”. No reason to go into LensCrafters if you can try it on and return for free. | ||

| Warp.dev | 7/14/2021 | $0 |

| The terminal hasn’t really changed in a few decades, but re-imagining how it would work with more features like autocomplete, shortcut snippets, and a shared environment for engineering teams could be extremely powerful. | ||

| Withings | 9/17/2011 | $4.13m |

| Huge opportunity to capitalize augmenting smartphones with peripheral devices. Their approach with virality around health products (auto-tweeting) is sick. | ||

| YAC.Chat | 11/25/2019 | $275k |

| Intersection of two interesting trends: increasingly distributed/remote teams in tech-centric companies, and audio being the next mobile/wearable frontier. Also powering a number other voice apps with its tech, which is an interesting distribution angle. | ||

| Zaarly | 5/15/2011 | $1m |

| If this reaches critical mass, it will change the world. Incredibly designed and fascinating story behind its launch. | ||

| Zapier | 6/20/2012 | $170k |

| This ties into many more business oriented services that IFTTT doesn’t and will undoubtedly get a lot of people/businesses paying for their (albeit expensive) premium plans | ||

| # Companies | Last Updated: | |

Companies with a star next to them are once I’m exceptionally bullish on given their current capital intake, likely valuation, and liquidation opportunity. All fundraising numbers (listed under pre-investments column) were obtained via Crunchbase and are meant to indicate the amount of outside capital put into the companies before the date listed. To simulate a real-world investing scenario, I will be adding (and not removing) companies on an ongoing basis. Feel free to correct any mistakes, point out companies you think are exciting, or provide any feedback.

Facebook Vulnerability: Like Clickjacking

The Facebook Open Graph Like Button is susceptible to a type of attack known as clickjacking. Basically, if the like button is embedded on the page you’re on, made completely transparent, then an attacker could trick you into Liking something without your discretion.

How the attack works:

1. User navigates to your page, like button is embedded invisibly

2. As user moves mouse, JavaScript is used to keep the button beneath the user’s cursor.

3. User clicks what they believe is a link on the page and “Likes” the attacker’s content instead.

4. User doesn’t see any notification of Liking the content, which results in a News Feed story.

5. News Feed contains mention of attacker’s content, which allows it to grow virally.

View Demo | View Source (button intentionally visible)

More advanced versions might use cookies to detect when a user is returning so they can actually use the site after presumably clicking the like button. Other modifications might include detection on when a user clicks the invisible iframe so it is removed without the user knowing and browsing returns to normal (this works in IE and Firefox, but not Chrome to my knowledge because of iFrame security). The above demo arbitrarily hides the button after 10 seconds and leaves the button visible for effect.

Twitter ran into a very similar attack last february with the propagation of a “Don’t Click” button. The main difference is that Twitter was able to block the hole by disabling iFrame embeds (basically if (window.top !== window.self), then Twitter is nefariously being iFrame embedded). Since the Like Button itself is an iFrame, Facebook can’t employ the same logic to detect clickjacking.

Advanced users would notice the change in cursor since the mouse is always located above a link and can’t be overridden since it’s in an iFrame. However, during the casual flow of browsing this would hardly go noticed.

Updated: New iPhone Developer Agreement Bans the Use of Third-Party Analytics and Services

The updated iPhone Developer Agreement includes stringent clauses around the acceptable use of storing, transmitting, and processing user data. Here is the updated section 3.3.9 in its entirety. I have added emphasis to clauses I would like to highlight:

3.3.9 The following requirements apply to You and Your Application’s use, collection, processing, maintenance, uploading, syncing, storage, transmission, sharing and disclosure of User Data:

– All use of User Data collected or obtained through an Application must be limited to the same purpose as necessary to provide services or functionality for such Application. For example, the use of User Data collected on and used in a social networking Application could be used for the same purpose on the website version of that Application; however, the use of location-based User Data for enabling targeted advertising in an Application is prohibited unless targeted advertising is the purpose of such Application (e.g., a geo-location coupon application).

– You may only provide or disclose User Data to third parties as necessary for providing services or functionality for the Application that collected the User Data, and then only if You receive express user consent. For example, if Your Application would like to post a message from a user to a third party social networking site, then You may only share the message if the user has explicitly indicated an intention to share it by clicking or selecting a button or checking a box that clearly explains how the message will be shared.

– Notwithstanding anything else in this Agreement, Device Data may not be provided or disclosed to a third party without Apple’s prior written consent. Accordingly, the use of third party software in Your Application to collect and send Device Data to a third party for processing or analysis is expressly prohibited.

– You must provide information to users regarding Your use and/or Transmission of User Data and explain how Your Application will use User Data, e.g., by providing information in the App Store marketing text that accompanies Your Application on the App Store, by adding an About box within Your Application, or by adding a link to Your privacy policy on Your website.

– You and the Application must take appropriate steps to protect any User Data from unauthorized disclosure or access. If a user ceases to consent to Your use and/or Transmission of User Data, You must promptly cease all such use and/or Transmission and destroy any such information from Your records (except to the limited extent necessary for Your Application back- ups and record-keeping or as otherwise prohibited by law).

Location Based Advertising

The first emboldened clause states that location based advertisements can only be included in advertisements whose only goal is providing location based advertising. My interpretation of this clause is that unless an application’s sole purpose is providing location based advertisements in the form of nearby coupons, offers, or sales, then location based advertisements are not allowed. This is interesting, because the promise of applications like FourSquare, Gowalla, and Loopt is that through a social network of seeing where your friends are, businesses will be able to add value to the experience by targeting users most likely to make a real-world purchase – if I check in to a store at the mall, what better opportunity for a business five stores down to promote their sale.

The line here is unclear in that I don’t use FourSquare (or any other check-in service) for the sole purpose of finding nearby deals, but rather to see where my friends are. The language in the Developer Agreement suggests that check-in services like the aforementioned will not be able to provide auxiliary location based ads. Ad networks looking to capitalize on the promise of location based advertisements will undoubtedly have a lot of qualms with this clause as it effectively eliminates the ability to provide fine-grained location targeting with GPS or AGPS, leaving the traditional city-level IP-Table lookups as the only means of approximating a user’s location. One has to question whether iAd will adhere to these same targeting guidelines.

Third-Party Data Providers

The second emboldened clause spells trouble for third-party providers building services on top of the iPhone ecosystem, including analytics companies, data stores like SimpleGeo, and potentially third-party ad networks. The clause states that an application can not include a third-party library which sends data to their servers for “processing”. I put processing in quotes because it’s an overloaded term that could mean a lot of things – If I throw some data into a database and count how much disc space I’ve used, that could be considered “processing”. It is unclear whether this bans third-party ad networks as all of them receive data from the device and run optimization analysis in some capacity. Whether or not Apple will enforce all current applications running networks like AdMob or MediaLets to switch to iAd remains to be seen, but the move would be highly controversial and would spark a giant clusterfuck of anti-trust violations from Google and the like.

The clause all but signals the death of third-party analytics software built to provide application developers information about how their applications are being used (Disclaimer: I was the co-founder of AppLoop, which we shut down about 14 months ago). The web example of these services is Google Analytics, which provides millions of people with useful information to optimize their websites and provide better user experiences. Apple previously didn’t make a public stance forbidding the use of third-party analytics tools like Flurry (which acquired Pinch Media a few months ago), MediaLets, or MobClix, but it is hard to put a spin on this agreement which would allow these services to operate under the new agreement.

This move comes at somewhat of a surprise given how important customer feedback is in the product development cycle – iPhone AppStore review quality is mediocre at best, and there really is no other way to optimize how applications are used to improve quality (something Apple has previously touted). If this is enforced, it will leave a gaping opportunity for Android developers to listen to their customers, improve application quality, and bring the Android ecosystem on par with the AppStore in terms of content quality, quantity, and diversity.

In all, the updates to section 3.3.9 allow Apple to selectively enforce whatever they want on whoever they want. Although they’re already doing this to some extent, the updated terms allow them to do so legitimately.

Update 4/14/2010

Venturebeat has posted an email received from an iPhone developer who received a response from Apple regarding Flurry, which was one of the analytics companies mentioned in this post:

We’ve reviewed your application and determined that we cannot post this version of your iPhone application to the App Store. It is not appropriate for applications to gather user analytics. Specifically, you may not collect anonymous play data from a user’s game. A screenshot of this issue has been attached for your reference.

In order for your application to be reconsidered for the App Store, please resolve this issue and upload your new binary to iTunes Connect.

It appears as if Apple is calling an audible on the new agreement as they don’t yet have definitive standards internally for what they will and will not allow:

They basically said the new clauses are for 4.0 (not accepting 4.0 apps yet) and they haven’t decided what will be allowed and what won’t be allowed. They said they will discuss with guys like [mobile analytics vendor] Flurry, etc.

This will be one to watch. It’s almost certain that Analytics companies just got shot in the foot, but the real question will be whether Apple forces developers to switch from Admob or MediaLets to its own proprietary iAd advertising network. I will reiterate this from my original post: the updates to section 3.3.9 allow Apple to selectively enforce whatever they want on whoever they want.

Did you mean: Google Maps

Let me ask a simple question. What would you expect to happen if you typed in http://google.com/mapss in to your browser bar? I’d be willing to bet that you’re looking to be directed to Google’s mapping service, but what do you find?

Ouch, that’s disappointing – now I feel like an idiot, and I still have to adjust my requested URL to be typo-free. Some people simply would have typed in “Google Maps” in to their browser’s built-in search, but not everyone uses this available functionality. Let’s see what happens when you do a plain Google search for “google.com/mapss”:

Much better. The current system is about as useless as it gets, but searching Google returns exactly what I want to see. For a company that strives on using data, Google is missing an opportunity to create value and display more search ads. It seems obvious to me that all misspelled Google product URLs should be directed through Google’s search engine rather than displaying the current “Not Found” dead end, providing more value to end users and creating more ad impressions/revenue for Google.

2010 Predictions

I’ve quietly been compiling a list of predictions for what’s going to happen in 2010 for the past few weeks, and it will be fun to look back in a year and see how I did. There are a leisurely 40 predictions – some bold, some straightforward – but I’m sure the unexpected will make 2010 one we’ll never forget. Let me know your thoughts, and feel free to disagree. So, enough chatter – here’s my predictions:

-

Mobile / Hardware

-

1. iPhone AppStore backlash continues and Apple does nothing about it.Apple has alienated developers and pushed away many prominent evangelists with its tyrannic policies around AppStore approval, regulation, and ambiguity. While the debate has certainly expanded in to mainstream media, I don’t see Apple changing its ways, at least not when it doesn’t need to. It will need to when an open alternative platform rises in popularity, but for now it’s Apple’s way or the high way.

-

2. Mobile CPA monetization in games gets hot.Incentivized CPA offers are already the De facto way many Facebook game developers choose to make money. It makes sense that CPA on the iPhone is soon to follow. A few small companies are making inroads now, but none are having the breakout success publishers are with social games on Facebook – it’s coming though. I predict 2010 will be a big year for CPA monetization in mobile social games.

-

3. E-Reader device popularity continues to rise. Amazon polishes its Kindle and B&N struggles to create comparable demand for Nook.Amazon has established itself as the digital marketplace for goods, and I predict that B&N will struggle to make the transition.

-

4. TechCrunch effectively loses CrunchPad lawsuit, but JooJoo fails anyway.Plenty of controversy here with contradicting stories from the two parties involved. Taking a step back, I find it hard to believe that Arrington – a previous lawyer himself – would neglect the opportunity to get assignment of intellectual property rights if there was any legitimate opportunity to do so. Regardless, the JooJoo is terribly overpriced, and skepticism around the lawsuit will make buyers wary of purchasing the device from a potentially ill-fated company.

-

5. Verizon doesn’t land with iPhone.I hope I’m wrong, but I don’t think Verizon will land the iPhone for a few reasons. Verizon started a huge campaign against AT&T which undoubtedly didn’t go over too well with the folks at Apple. Apple even partnered with AT&T in an ad campaign in response to Verizon’s attacks. Verizon’s flagship smartphone is now the Droid, and I find it unlikely that Apple will expand its GSM hardware to support Verizon’s CDMA network. I do hope Apple does prove me wrong though.

-

6. Microsoft struggles with Windows 7 Mobile and remains irrelevant in the mobile space.Windows 7 Mobile has been postponed in to obscurity, closing Microsoft’s window in the mobile market.

-

7. Apple Tablet launches with pseudo-iPhone OS complete with AppStore.Lots of speculation here, but a tablet would give Apple an entrant in the leisure-reading market that is sure to make mac fans drool with envy.

-

8. Android proves itself as a formidable competitor to Apple and becomes second overall to iPhone by year’s end.The Droid is hands-down the best non-iPhone phone on the market. While Android doesn’t have the polish that comes from the user experience prowess at Cupertino, it does have the advantage of diversification that could prove it a formidable competitor. Apps published on the Android platform have the disadvantage of being on multiple device types with no least common divisor, but at the same time it is a blessing. I think that Android will slowly and incrementally find itself the flagship smartphone (and generic device) operating system, and I think 2010 will be the year that this starts to become evident.

-

9. Palm continues to push out mobile devices with little demand.Palm had all its marbles in the Pre basket, and unfortunately the folks at Apple cut a hole in the bottom. Enough said.

-

10. Square realizes its bottleneck is additional hardware, so it gives card reader away for free.Jack Dorsey’s Square project is one of the most intriguing startups of 2009. After the smoke from the fireworks clears, I think Square’s main problem will be convincing people to get additional hardware. Without the additional hardware, the service is useless, and I’m not certain that consumers will be able to see tangible value in the service without testing the product first-hand. To combat this, Square needs to make acquiring the hardware as frictionless as possible, so I believe they’ll release the reader for free. Alternatively, they could remove the external hardware dependence by utilizing the built-in camera on smartphones and apply some OCR in a similar fashion to the way Red Laser reads barcodes.

-

Acquisitions

-

11. DropBox gets acquired.

-

12. GitHub gets acquired.GitHub has quietly been building a base of extremely sought after users that any company would love access to. I wouldn’t be surprised to see them make a nice exit for access to a great product/team with valuable users.

-

13. “Spray and pray” investment model becomes validated as a few players have significant exists.The “Spray and Pray” model of angel investors like Ron Conway and incubators like YCombinator has been under a lot of scrutiny since its inception. I expect 2010 to be plush with exits including a number of companies backed by these spray and pray investors, largely validating the model.

-

Geo

-

14. Facebook will not enter the geo space in 2010. If it does, it won’t be through an acquisition.Most experts say that Facebook is poised to take over geo. I would agree with that statement, but I don’t think it will happen in 2010. Facebook has been under a lot of scrutiny for it’s recently changed privacy policies. Everyone knows that FaceBook wants its users to be as open as possible, much to the cry of privacy zealots everywhere. Adding location data to the mix only adds fuel to the fire, and I think Facebook will wait until its other privacy issues have cooled down. That being said, if Facebook does jump in to the nascent geo arena this year, I do not think it will be via acquisition (of a service like Foursquare or Gowalla). Facebook would likely make location an additional type of status/wall-post update, and very little of the code from existing services could be ported over easily, so it would simply be a talent buy (which does frequently happen). As a definitive prediction (and one that many disagree with), I don’t think FaceBook will enter the geo space this year, but when it does, it will be a force to be reckoned with.

-